Surprise! It’s time for a Minimum Wage Pop Quiz. Put away your books (and your smart phones) and take out a pen and paper.

(Don’t worry. It won’t hurt, much.)

Minimum Wage Pop Quiz – Questions

- What is the minimum wage in Florida?

- Federal minimum wage

A. How many states use the federal standard?

B. What is the federal minimum wage? - Adjustments to minimum wage

A. How many states have already adjusted their minimum wage in 2020?

B. How many states will adjust their minimum wage later this year? - How many states have promised to get their minimum wage up to $15 an hour?

Not so easy, was it? Good payroll software will have the answers set automatically so you don’t have to worry about it. But you should have a basic understanding and a general overview. So let’s see how you did. Grade your own work.

Minimum Wage Pop Quiz – Answers

- The minimum wage in Florida was raised to $8.56, from $8.46, at the beginning of the year. Did your payroll software automatically update its settings?

- Federal minimum wage

A. Eight states use the federal minimum wage and another 14 states match their state minimum wage to the federal minimum wage.

B. That means that almost half of the states use the federal standard, which has not changed since 2009 (not even for inflation): $7.25 an hour. No changes make things easy for payroll software, but don’t count on this staying the same for long. - Adjustments to minimum wage

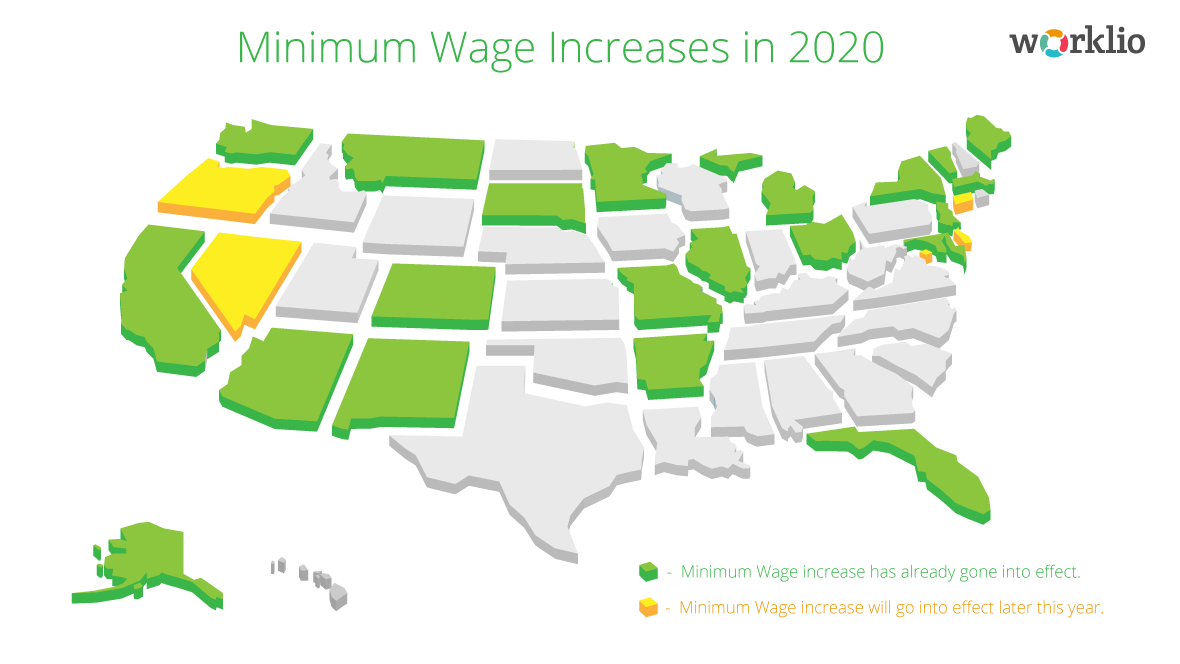

A. Twenty-one states have made changes to some aspect of their minimum wage so far in 2020.

B. Another four states, and the District of Columbia, will make changes later this year. - Seven states — California, Connecticut, Illinois, Maryland, Massachusetts, New Jersey, and New York — are moving toward the $15 so-called “Living Wage” by 2025. Washington, D.C. will get there, too. And New York City and Seattle already have $15 an hour as their minimum wage.

* * *

Don’t worry if you didn’t do real well on this quiz. Consider it an informative exercise to remind you of the complexity of running payroll.

Just to drive the point home: imagine if you have workers in multiple states and, to an even more complex level, if you have workers who work in multiple states and need to meet different criteria within the same payroll run.

Remember that you probably have to post the new values in a public place. It’s best to do so, lest you get a fine from the Department of Labor.

* * *

How does your company maintain minimum wage rates, state tax rates and local tax rates? Does your Payroll software have minimum wage warnings tied to the state and local guidelines?

See how Worklio helps with due diligence. Get a personalized demo today.

Call 1-844-996-7554 or send an email to demo@worklio.com.